What is a CFD and where to trade CFDs in Canada? Everything you need to know.

What is a CFD?

CFD stands for Contract for Difference, a type of financial agreement that allows investors to speculate on the price movements of an underlying asset without taking ownership of it. A trader will open a long or short position in the asset, entering into an agreement with the CFD broker to exchange the difference in the price of the asset from when the contract was opened until it is closed. If the price of the asset moves in a favorable direction, the trader will make a profit, and if it moves in an unfavorable direction, the trader will suffer a loss.Should You Trade CFDs?

CFD trading has several advantages that make it an attractive option for investors. Firstly, CFDs offer higher leverage than traditional financial vehicles, allowing traders to take significant positions with less capital at risk. Secondly, CFDs offer diversification as commodities, Forex, major stocks, and indexes are all available for trading from the same platform. Thirdly, CFDs carry low costs as there are no fees and the minimum deposits are low. Finally, CFDs are a great option for day-traders, as some restrictions on high-frequency trading of stocks do not apply to CFDs.Benefits of CFD Trading

CFD trading offers several benefits for investors, such as:- Leverage: CFDs offer higher leverage than traditional financial vehicles, allowing traders to take significant positions with less capital at risk.

- Diversification: CFDs offer diversification, as commodities, Forex, major stocks, and indexes are all available for trading from the same platform.

- Low Costs: CFDs carry low costs as there are no fees and the minimum deposits are low.

- Flexibility: Investors can access the markets 24 hours a day and can trade in any currency. Additionally, CFD traders can use their platform to build strategies and employ multiple strategies simultaneously.

- Testing: Traders can test strategies in a risk-free environment through the use of a demo account.

Risks of CFD Trading

CFD trading is a leveraged investment and carries with it a high degree of risk. As such, investors should be aware of the potential for losses to exceed their original investment. Additionally, CFDs may not be suitable for all investors, as the high degree of leverage can work both for and against traders.- Leveraged trading increases exposure to potential losses

- Losses can exceed initial capital invested

- CFDs may not be suitable for all types of investors

- Rapid price movements can lead to significant losses

- There is no guarantee of profits when trading CFDs

Strategies for CFD Trading

Successful CFD trading requires the development and implementation of a trading strategy. Some of the most common strategies used by CFD traders include:Trend Following

Trend following strategies involve monitoring price movements in the market and investing based on the established trends. This strategy is suitable for traders who are comfortable with longer-term trades and have the patience to wait for their profits.

Breakout Trading

Breakout trading strategies involve looking for periods where prices have been trading in a range and then investing when a breakout is seen. This strategy is better for short-term traders who are looking for quick profits.

Scalping

Scalping strategies involve making multiple trades a day, usually with a much smaller profit target than trend following or breakout trading strategies. These strategies are best suited to traders who are comfortable with taking on more risk and who have the ability to monitor the markets often.

Risk Management for CFDs

Risk management is a key component of successful CFD trading and should not be overlooked. Risk management involves a variety of tasks and strategies, including setting stop losses, monitoring position size, avoiding overtrading, and practicing good money management.

When setting stop losses, CFD traders should set a clearly defined exit point for a trade at which the position will be closed in order to limit potential losses. This can help to protect against large, unexpected losses and ensure that the trade is managed properly. Additionally, position size should be monitored to ensure that the capital used for trading is sufficient to cover any potential losses.

It is also important to avoid overtrading, which is the practice of making multiple trades in a short period of time without considering the risks involved. Overtrading can lead to large losses and should be avoided. Finally, it is important to practice good money management and ensure that the funds used for trading are not needed for other, more important purposes.

By following these risk management strategies, CFD traders can be better prepared to manage their trades, minimize losses, and maximize profits.

Conclusion

CFD trading can be a great option for traders looking for diversification, flexibility, and the ability to take advantage of leverage. However, it’s important to remember that CFD trading also carries with it a high degree of risk and should not be undertaken lightly. It is also important for traders to develop and implement a sound trading strategy to maximize their chances of success. With the right knowledge and preparation, CFD trading can be a great tool for investors.

Where to trade CFDs in Canada?

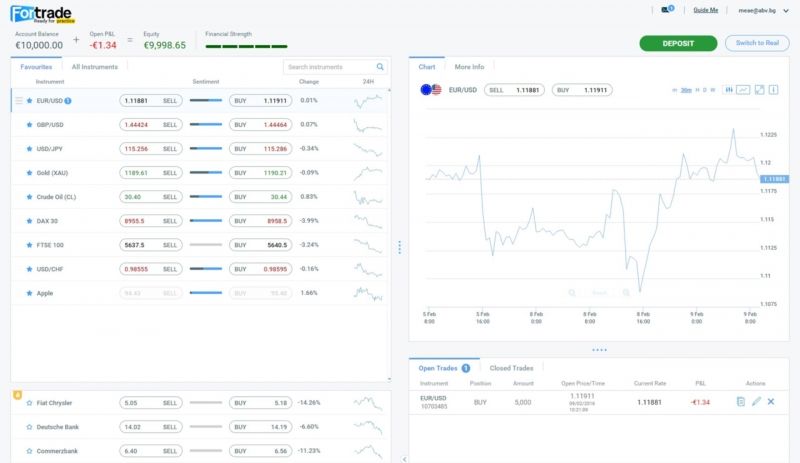

For CFD traders in Canada looking for a secure and reliable broker, look no further than Fortrade. They are regulated by the Investment Industry Regulatory Organization of Canada (IIROC) and a member of the Canadian Investor Protection Fund (CIPF). Furthermore, Fortrade offers amazing customer service, with account managers that genuinely help you succeed and promptly handle any issues.

Additionally, traders can take advantage of Fortrade Academy, a wealth of information for new traders, and their user-friendly trading platform, complete with a demo version to test out your strategy. Make sure to check out Fortrade if you want to trade CFDs securely in Canada. They offer competitive spreads and low commissions, advanced market analysis tools, and other features designed to provide traders with a comprehensive trading experience. Additionally, Fortrade ensures the highest levels of customer service and security, providing traders with a secure and reliable trading platform. Finally, trading with them is convenient and accessible, as it is available across multiple platforms and devices.

|

| Fortrade Trading Dashboard |

Disclosure:

Additional Disclosure:

The views expressed in this article are the opinions of the author as of the date of publication and do not constitute a recommendation to buy or sell any asset. Opinions are subject to change without notice and the author is under no obligation to update their views on this blog. This is not investment advice and is being provided for informational purposes only. You should not rely solely on the information or opinions provided in our content, rather use them as starting points for your own due diligence and draw your own conclusions based on your own research. The author cannot guarantee the veracity or completeness of any information provided in this blog and will not be responsible for inadvertent errors or omissions. Please do your own due diligence and invest responsibly as you alone are responsible for your own investment decisions. Investments carry risk, are not guaranteed, and can lose value.

Comments

Post a Comment