|

| (Shutterstock) |

The Basics*

(If you already understand the basics of options, skip to the next section, "Selling vs Buying")

What are Call Options?

A call option contract gives the owner the right, but not an obligation, to buy 100 shares of a stock at a fixed price, referred to as the "strike price", on or before the expiration date of the option.

For example, let's say you bought a September call option with a $10 strike. If the stock price reaches $15 before the expiration date (September 17th, 3rd Friday), then you would have profited $500 which is $100 for each $1 increase in the underlying stock.

A holder of a call option has several methods available to close the trade.

If the option is in profit; they can sell the option at a profit or hold to expiry and exercise the call option and buy the 100 shares at the strike price.

If the option isn't profitable; they can sell the option for a loss before expiration or hold and let the option expire worthless if it stays below the strike.

What are Put Options?

A put option contract gives the owner the right, but not an obligation, to sell 100 shares of a stock at a fixed price, referred to as the "strike price", on or before the expiration date of the option.

For example, let's say you bought a September put option with a $10 strike. If the stock price reaches $5 before the expiration date (September 17th, 3rd Friday), then you would have profited $500 which is $100 for each $1 decrease in the underlying stock.

A holder of a put option has several methods available to close the trade.

If the option is in profit; they can sell the option at a profit or hold to expiry and exercise the put option and sell 100 shares at the strike price, creating a short position unless they owned the underlying shares beforehand.

If the option isn't profitable; they can sell the option for a loss before expiration or hold and let the option expire worthless if it stays above the strike.

Selling vs Buying

Here's the thing, we don't like either of these options by themselves. In normal circumstances, we would rather be the one selling those options, not buying them. This is because there is consistent money to be made farming the time value of options. Options are priced based on their intrinsic value plus time value which is affected by implied volatility. The time portion of the equation decays over time and the closer to expiration, the less valuable the option. High implied volatility of a security can often create a situation where the options are trading at inflated values, and this creates an opportunity to sell them. Here are some examples of successful strategies that utilize selling options to create income consistently.

Selling Covered Calls

A covered call is when an investor sells call options against a stock they already own.

If you buy shares to sell covered calls, it is recommended to choose a stock that you would like to own regardless. When you sell the call, you give the buyer of the option the right to buy 100 shares of the underlying stock from you at the strike price, at or before expiration. It is "covered" because you already own the stock that you would have to sell if the call option is exercised.

The buyer of the option pays you a premium in cash that gets immediately credited to your account. This is your income from selling the option.

This strategy is a great source of income, but you should only do it with stocks that you actually would rather hold than sell. It's just that you wouldn't mind being paid in advance to agree to sell them at a certain price that's higher than the current price, by a certain date. The ideal situation for you is that the sold options expire worthless, and you can sell them again for the next expiration while the stock slowly appreciates. If you are holding stocks that you know you would sell at a certain price, then what is stopping you from selling someone the option to buy them from you at that price?

Covered calls are a great low-risk way to increase your portfolio gains.

Selling Puts to Own Shares

Selling puts to own shares is a way for savvy Options traders to buy the stocks they want to own at a discount. That's right. You can buy any stock you would like to own at a discount by selling puts on the shares.

How to do this? Simply choose the stock you want to own 100 shares of, and sell a put option for a price that is slightly lower than the current price. That way, if the price of the stock you want to own doesn't drop in value, you collect the premiums for the options you sold, and they expire worthless, giving you a 100% gain. If the price of the stock you want to own drops below the strike, then you buy the shares of the stock you want to own anyway at a price that you already decided would be a good price to buy them at, while collecting a premium(hence the discount). It's a win-win scenario that you can set up. Similar to the Covered Calls strategy above, an important pre-requisite to the strategy is picking a stock that you would like to own. It's worth repeating because the entire risk of these two strategies is in holding the underlying.

Wheel Strategy

The Wheel Strategy combines both of the strategies above. You pick a stock you wouldn't mind owning. You sell a put to own the shares. If it expires, you sell another put. You repeat this every option cycle until you are eventually assigned the shares. Once you are eventually assigned those shares, you sell covered calls on those shares. This way you buy a stock you want to own anyways at a discount, after collecting weeks of premiums, then get paid premiums while holding the stock until it reaches a price you were going to sell it at anyway, and your sold call gets exercised and the wheel is complete. At this point, you could re-invent your wheel and sell another put, or you could choose another stock and wait for a better target price to start the wheel again on the particular underlying. We currently use a slightly modified version of this strategy ourselves.

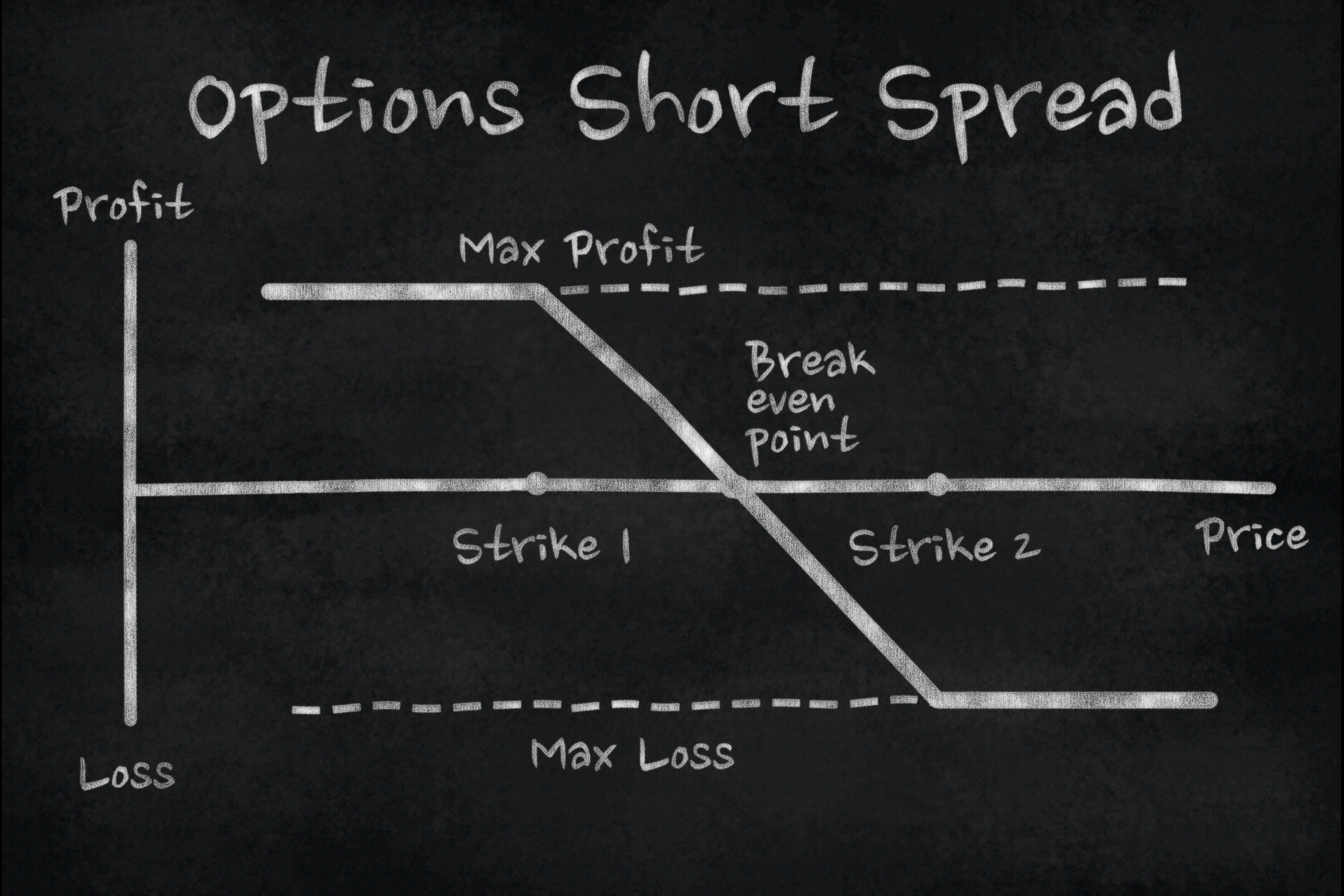

Options Spreads

The most popular way for options grinders to make an income is through spreads. That's because a skilled spreads trader can profit consistently in any market conditions with a replicable setup. A spread trader takes a position on two or more different options contracts tied to the same underlying security. They create an options spread by buying and selling options on the same stock.

Options spreads are the most effective way to limit risk while trading in options.

There are several types of Options Spreads including but not limited to;

Credit Spread

Debit Spread

Ratio Spread

Getting into the specific details of each one of these spread strategies is beyond the scope of this article, though if you are interested in learning more about this low volatility way to build an income through options,

Nic Chahine from Benzinga/Marketfy has a course on Options Spreads that is in our opinion, the best way currently available online to step your game up to a new level. If you already kind of know what you are doing, or are a pure novice, he can elevate your game to play ball with the pros. If you already fancy yourself somewhat of a beast in the realm, then you already know listening to this dude and finding a way to increase your edge will pay for itself within one day for you.

If you're serious about creating an income from Options or increasing your existing profits, following Nic's advice is the best available way for you to get there from where you are now, and worth every penny. He offers a 30-day money-back guarantee, so you really have nothing to lose for an opportunity to learn the skills it takes to make a consistent income at this in any market.

These are the best ways to create income with Options. No matter which way you choose, your results will be highly correlated to the strength of the underlying you choose. By doing your due diligence, and learning from guys like Nic to analyze charts to find these opportunities, you can be well on your way to building that bankroll to the next level.

Disclosure:

Ramy Capital is in an affiliate agreement with Marketfy/Benzinga for a share of revenue. I wrote this article myself, and it expresses my own truthful opinions. Ramy Capital trades with our own wheel strategy. We have attended demo training sessions of this course and are very confident in the knowledge and teaching ability of the instructor. The information and recommendation provided do not serve, either directly or indirectly, as financial advice. Trading options may not be suitable for your specific situation. Past performance is not indicative of future performance. Your results trading these strategies could be negative. Trading options involve risk.

Additional Disclosure:

The views expressed in this article are the opinions of the author as of the date of publication. Opinions are subject to change without notice and the author is under no obligation to update their views on this blog. This is not financial advice and is being provided for informational purposes only. You should not rely solely on the information or opinions provided in our content, rather use them as starting points for your own due diligence and draw your own conclusions based on your own research. The author cannot guarantee the veracity or completeness of any information provided in this blog and will not be responsible for inadvertent errors or omissions.

Comments

Post a Comment